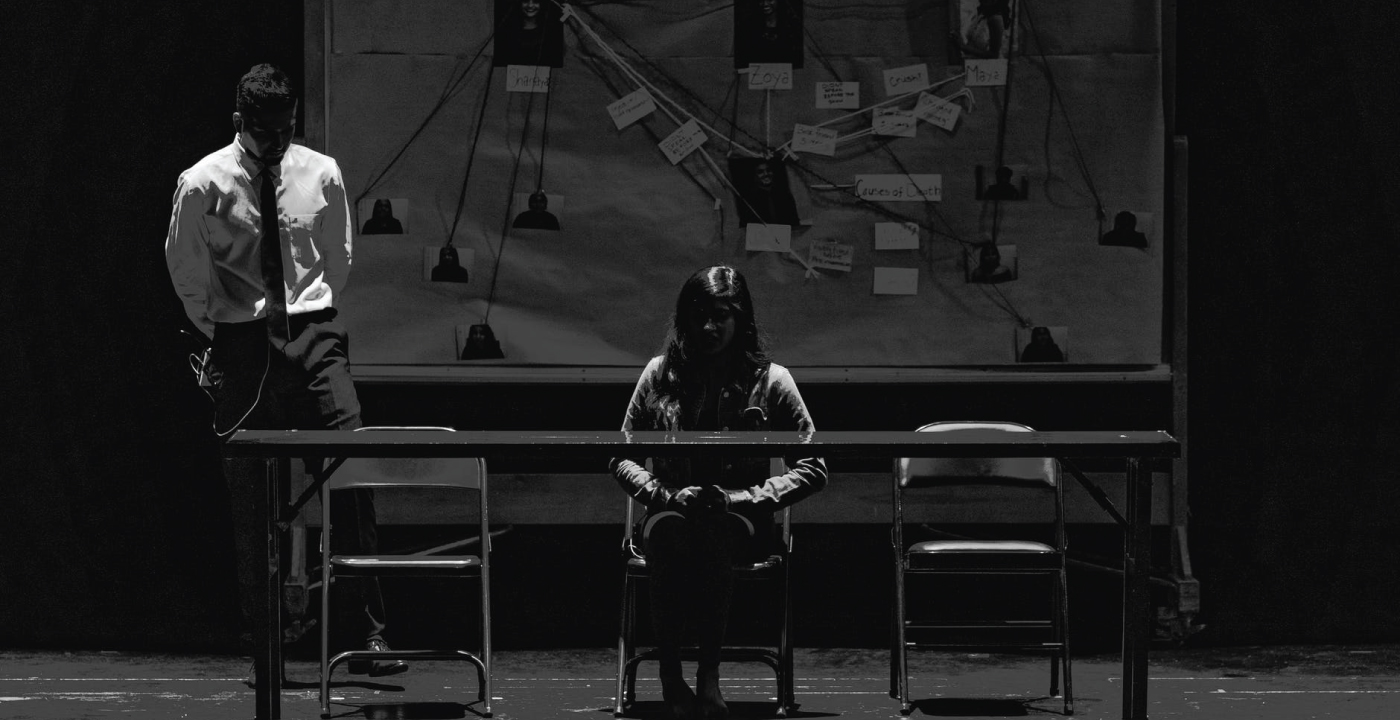

Crime Insurance

The insurer shall indemnify the insured for their loss sustained at any time resulting from either:

(A) Fraud or dishonesty committed by any employee (acting alone or in collusion with others); or

(B) a fraudulent act committed by any other person; which is committed with the principal intent to cause the insured to sustain such loss and is first discovered by the insured during the policy period or the discovery period.

The Insurer indemnifies the Insured for loss sustained, plus Costs, Charges and Expenses, as a consequence of a dishonest, fraudulent or reckless act by any other person.

What is covered?

- 1. Transit Coverage:- Losses caused by the actual destruction, disappearance or wrongful abstraction of Money or Securities outside the Premises.

- 2. Premises Coverage:- Losses caused by the actual destruction, disappearance, wrongful abstraction or Computer Theft of Money or Securities within or from the Premises.

- 3. Employee Theft Coverage:- Loss of Money, Securities or other property caused by Theft or forgery by any identifiable Employee of any insured acting alone or in collusion with others. This section includes any Employee Benefit Plans.

- 4. Depositor’s Forgery Coverage:- Losses caused by forgery or alteration of, on or in any cheque, draft, promissory note, bill of exchange, or similar written promise, order or direction to pay a sum certain in Money, made or drawn by, or drawn upon the Insured, or made or drawn by one acting as agent of the Insured, or purporting to have been made or drawn.